Empower your organisation with outsourced payroll management

Empower your organisation with outsourced payroll management

Payroll Management for Companies of All Sizes

Payroll is the total amount a company pays to its employees in a certain time period. Important parts of payroll involve time and pay administration, and it can deter many small businesses because of its complex history. Managing payroll is complicated and time-consuming. You need to keep various factors in mind, including leaves adjustments and reimbursements – all while being mindful of compliance with tax and statutory regulations. With too little time and knowledge, businesses may keep making mistakes such as paying an improper amount, which displeases employees and leads to fines from the government.

Implementing an efficient payroll management system can help you maintain compliance while also making sure your employees are paid accurately and on time. Hiring a payroll service provider can help you in a number of ways, from decreasing employee dissatisfaction to reducing the risk for government penalties. ZAT Consultants provides cost-effective and efficient payroll services, so one of these businesses processing outsourcing, outsourcing providers would be a great way for you to manage your payroll.

Challenges Face in Processing Payroll

Outsource accounts payable services can help you in the following manner –

Time-consuming

When processing payroll, it is important to pay attention to details. Processing payroll can be time-consuming and tedious, so mistakes are likely to occur.

Compliance

One another concern for payroll management is compliance and tax filing, as well as changes in the legislation and existing laws.

Accuracy

Accuracy is a trademark of any payroll management system; however, the amount of data payroll processing is voluminous. Ensuring the accuracy of payroll data is crucial for optimum performance.

Fraudulence

Some payroll fraud that people in an organisation can commit will impact the organisation, like ghost employees, falsified wages and commission, or even fake insurance claims.

Dedicated Team

In most cases, the HR and finance departments both take responsibility for payroll, but this only adds up to the workload for both departments.

Cost Implications

Processing payroll is quite costly, and one needs to invest in software and human resources. This hinders the overall efficiency of the process.

Payroll Management Solutions by ZAT Consultants

As an outsourced payroll services provider, we are the experts you are looking for. Services include –

- Payroll data entry, payroll data processing including tax calculation

- On-time pay slip generation and emailing

- Monthly, Annually Employer or Statutory compliance

- Calculating the exact amount due to employees after withholding taxes

- Recordkeeping & administration

- Map the timesheets and prepare employee payslips and salary

Payroll Process for Australian Business

Setting up a System

We set up a system according to the schedule chosen by you, and then we prepare a calendar with relevant dates.

Sharing of Data

Important data and timesheets are shared through email or via cloud storage services like Dropbox or Google Drive.

Processing of Data

Based on inputs received from you, we calculate gross pay, deductions, net pay, and so forth.

Payment

We process all employee payments through a batch file which is sent to the Bank for upload.

Review, Follow Up and Revisions

We review the activities at constant intervals, ask for your feedback and make revisions wherever required.

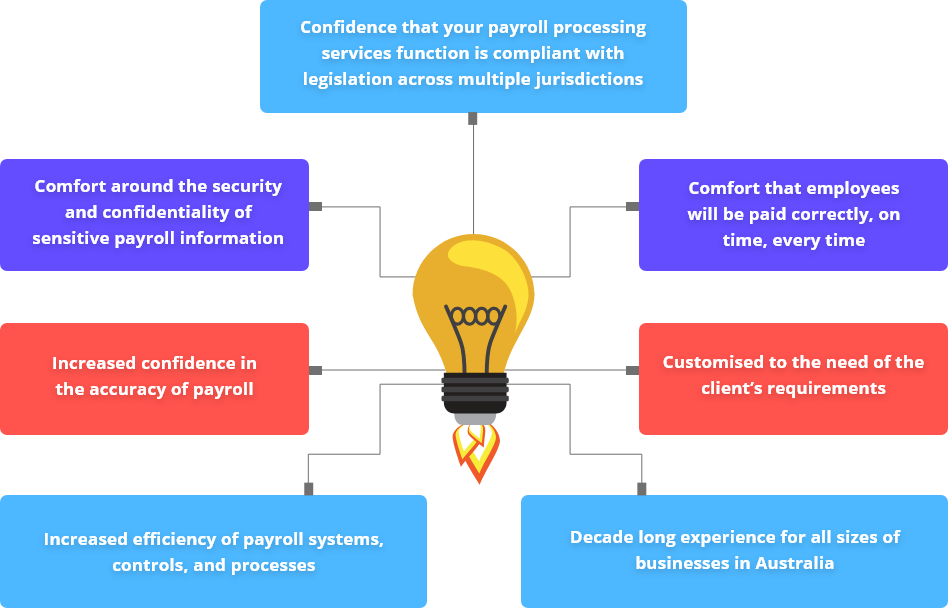

How would you benefit from the Outsourced Payroll Solutions by ZAT Consultants?

Outsourcing to a team of highly-trained professionals can ensure accurate payrolls and many other benefits. For over a thousand payslips each month, the ZAT Consultants team has a wide knowledge of payroll methods and can provide a high level of service to both sides of an advantageous payrolling relationship. Some other benefits of choosing Whiz Consulting for your Payroll Service are –

- Increased efficiency of payroll systems, controls, and processes

- Customised to the need of the client’s requirements

- Decade long experience for all sizes of businesses

- Increased confidence in the accuracy of payroll

- Comfort that employees will be paid correctly, on time, every time

- Ease about the security and confidentiality of sensitive payroll information

- Confidence that your payroll processing services function is compliant with legislation across multiple jurisdictions

Payroll Management Solutions By ZAT Consultants

You need to understand the process of payroll, or you can fall behind. Outsourcing payroll is not new, and many businesses have hired it to relieve their own burden. It has helped many save money and stay in compliance with local laws and regulations. For a business, it is essential to know the process of payroll – pay calculation, allowances, deduction, payment of leaves, generation of payslips, calculation of taxes, as well as timely payroll tax payments. And these are best left in the hands of experts.

ZAT Consultants has over a decade of experience providing clients with an affordable alternative to in-house payroll services. We provide timely reporting of all payroll compliance. We at ZAT Consultants have been providing in-depth payroll management services for over a decade now. We offer an affordable way for our clients to take away the payroll burden by providing a time-saving and cost-effective alternative to internal processing. We provide our outsourced services in the US, the UK, Australia, and other countries and offer these complications solutions to ensure cost-effectiveness, efficiency, and accuracy

Frequently Asked Questions (FAQs)

Payroll outsourcing services are the services that help you deal with payroll processing. Payroll outsourcing services help tackle everything from mapping timesheets to preparing employee payslips. Payroll is a particularly time-consuming and complex activity, and thus it is best handled by experts. When a business lacks the time and resources to handle these tasks internally, they outsource payroll services from payroll service providers.

Outsourced payroll is a great way to improve your productivity. As a business owner, your main priority is your business and the main operation, which is producing goods or providing services. Payroll is not a core task but essential and can take a toll on your productivity. Additionally, provided you have to conduct payroll weekly, fortnightly or monthly, it will only increase your burden. Outsourced payroll solutions providers will take away this burden and make payroll management a breeze for you.

Quality of payroll services matters because payroll is associated with one of the essential resources of a business – human resources. Paying your employee on time accurately is very important. If your payroll service providers are not efficient enough, your business will have to face employee dissatisfaction or, worse, face penalties.